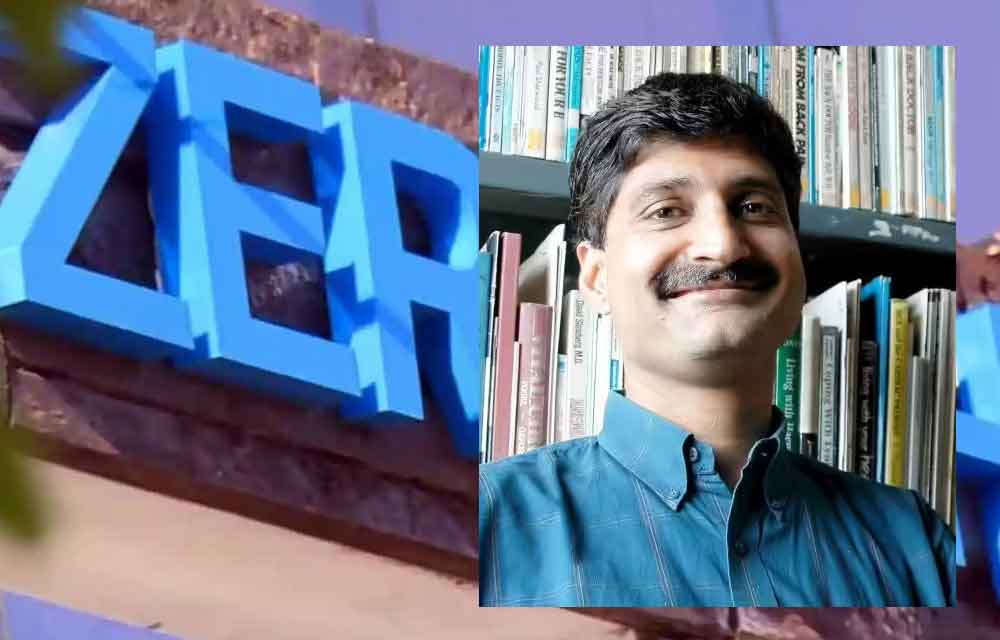

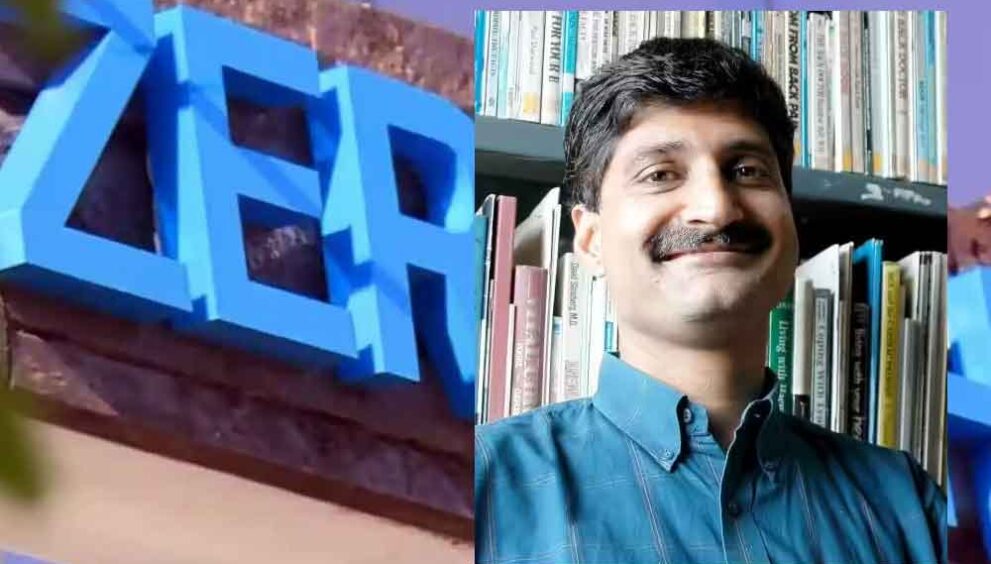

Zerodha Faces Backlash: Dr. Aniruddha Malpani Accuses Brokerage of Rs 5 Crore Withdrawal Scam Amid Rising Investor Frustrations

Mumbai, November 4, 2025 – In a heated public spat that’s ignited debates on X (formerly Twitter), prominent Mumbai physician and high-net-worth investor Dr. Aniruddha Malpani has slammed Zerodha, India’s leading discount brokerage, labeling its Rs 5 crore daily withdrawal limit a blatant “scam.” With over Rs 42 crore parked in his Zerodha demat account, Malpani’s accusations underscore growing concerns among affluent retail investors about access to their own funds in the booming Indian stock market.

The Core of the Controversy: Withdrawal Limits in Zerodha Accounts

Dr. Malpani, known for his outspoken views on healthcare and investments, took to X on November 4, 2025, to vent his frustration. He alleged that Zerodha’s policy of restricting daily cash withdrawals to Rs 5 crores effectively traps client money, allowing the firm to “use” these funds without granting investors full, immediate access.

“This is a scam. Zerodha holds Rs 42 Cr of my money but won’t let me withdraw more than Rs 5 Cr per day. They’re profiting off our idle cash while we can’t touch it,” — Dr. Aniruddha Malpani on X, tagging Zerodha’s official handle and CEO Nithin Kamath.

The physician’s post, which has garnered thousands of likes, retweets, and replies within hours, strikes a chord with India’s burgeoning retail investor base. As stock market participation surges—thanks to apps like Zerodha—high-value clients like Malpani are questioning whether such limits prioritize broker security over client rights. This Zerodha withdrawal limit controversy arrives at a time when retail investments in India have crossed Rs 100 lakh crore, per recent NSE data, amplifying calls for transparent fund management.

Zerodha CEO Nithin Kamath’s Swift Defense: Security, Not Scam

Zerodha’s response was equally rapid and firm. CEO Nithin Kamath, a vocal industry advocate, replied directly to Malpani’s thread, explaining the Rs 5 crore cap as a “standard security measure” designed to curb fraud, unauthorized transactions, and operational errors.

“We’re committed to protecting your funds, Dr. Malpani. For amounts above Rs 5 crores, we process via manual approval—fully compliant with RBI and industry guidelines. This ensures safety without undue delays,” — Nithin Kamath’s reply on X.

Kamath further emphasized that Zerodha handles over Rs 5 lakh crore in client assets daily, making robust safeguards essential. He invited Malpani for a direct discussion, highlighting the brokerage’s track record of zero major fraud incidents. Zerodha’s stance aligns with regulations from the Securities and Exchange Board of India (SEBI), which mandates risk mitigation protocols for large outflows, though critics argue these can feel restrictive for legitimate high-net-worth individuals (HNWIs).

Broader Implications for India’s Retail Investing Boom

This Zerodha scam accusation isn’t isolated—it’s a flashpoint in the evolving dynamics of India’s retail investing landscape. With demat accounts swelling to over 15 crore in 2025, brokerages like Zerodha, Groww, and Upstox have democratized trading but faced scrutiny over liquidity and fund safety. Malpani’s case spotlights HNI challenges: While small investors withdraw seamlessly, ultra-wealthy clients often navigate manual processes, potentially delaying access during market volatility.

X reactions poured in, with #ZerodhaScam trending briefly.

- Supporters of Malpani decried “broker overreach.”

- Defenders praised Zerodha’s low-cost model and reliability.

One user quipped: “Rs 5 Cr limit? That’s more than most Indians earn in a lifetime—cry me a river.” Another echoed Malpani: “If they can invest our money overnight, why can’t we withdraw it?”

Experts weigh in: Financial advisor Ravi Singh notes, “These limits prevent systemic risks, but brokers must communicate better to build trust.” As India’s market cap nears $5 trillion, such incidents could spur SEBI to revisit payout norms, balancing innovation with investor protection.

What This Means for Zerodha Investors and the Future of Broking

For Zerodha’s 1.5 crore+ users, the episode serves as a reminder: While the platform’s zero-brokerage trades revolutionized investing, policies like the Rs 5 crore withdrawal threshold demand clarity. Malpani’s Rs 42 crore stake exemplifies the stakes—literally—for HNWIs who fuel mutual funds and IPOs.

As the dust settles on this November 4 showdown, one thing’s clear: In India’s high-octane investing arena, accessibility isn’t just convenience—it’s a battleground. Investors, take note: Review your broker’s terms, diversify holdings, and stay vocal. For now, Zerodha holds the line, but voices like Malpani’s ensure the conversation on fund freedom rages on.

Stay tuned to NRIGlobe.com for the latest in global finance, NRI investments, and market movers. This story will update as new developments emerge.

English

English