EV Sales in America Collapse After Subsidies End

EV Sales in America Collapse After Subsidies End

US EV Market Crashes 2025: Electric Vehicle Share Hits 5.4% After Tax Credits End – Lessons for India’s Growing EV Ambitions

December 18, 2025 – While India accelerates its electric vehicle push with ambitious targets and new incentives, the United States is witnessing a dramatic slowdown. Latest data shows U.S. EV sales plunged to a mere 5.4% market share in November 2025 – the lowest in over three years – following the abrupt end of the federal $7,500 tax credit.

For the global Indian diaspora and NRIs closely tracking automotive trends back home and abroad, this sharp U.S. reversal raises critical questions: Can India sustain its EV momentum without heavy, long-term subsidies? And what can Indian manufacturers learn from America’s post-incentive reality?

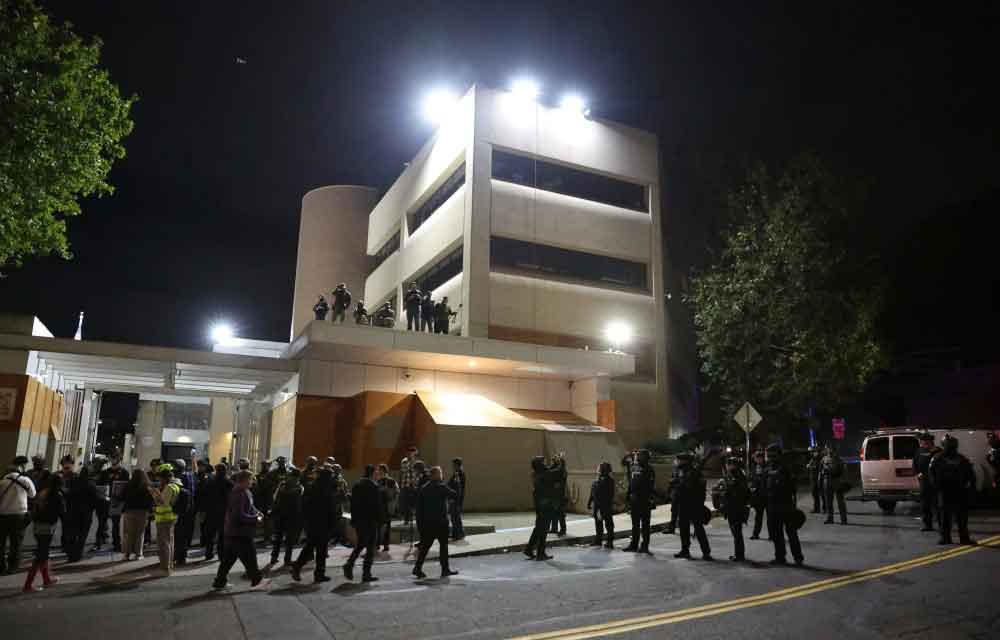

The Shocking U.S. Numbers: From Boom to Bust Overnight

According to Cox Automotive’s EV Market Monitor (released December 15):

- November Market Share: Only 5.4% (down from 5.8% in October and record highs above 11% in Q3).

- Sales Volume: Estimated 70,255 units – a massive 41% drop year-over-year.

- Inventory Pile-Up: Days’ supply reached 149 – the highest since early 2024.

- Top Brands: Tesla still dominated (~39,800 units), followed by Rivian, Ford, Chevrolet, and Hyundai.

The primary trigger? The federal EV tax credit expired on September 30, 2025, prompting a frantic Q3 buying surge that artificially inflated earlier figures. Once the incentive vanished, demand evaporated.

Why This Matters to India and the NRI Community

India’s EV story is heading in the opposite direction – for now:

- Government targets: 30% EV penetration by 2030, backed by FAME subsidies, PLI schemes, and state-level incentives.

- Rapid growth: Two- and three-wheelers already dominate India’s EV sales, with companies like Ola Electric, Ather, and Tata Motors posting strong numbers.

- Affordable focus: Models under ₹10-15 lakh are gaining traction, unlike premium-heavy U.S. offerings.

Yet the U.S. collapse serves as a cautionary tale:

- Subsidy Dependence: America’s EV growth was heavily propped up by tax credits. Without them, high prices and range anxiety resurface.

- Hybrid Surge: U.S. buyers are flocking to hybrids (Hyundai +42% YoY), suggesting consumers want electrification without full commitment – a trend already visible in India’s petrol-hybrid popularity.

- Global Contrast: While the U.S. stalls, China and Europe charge ahead with sustained incentives and cheaper models.

For NRIs investing in Indian auto stocks or planning to bring EVs home, this highlights the need for sustainable, subsidy-independent demand.

Hybrids Gain Ground as Pure EVs Falter in the US

Interestingly, while battery electric vehicles (BEVs) crashed in America, hybrids are booming:

- Toyota, Hyundai, and Kia report record hybrid sales.

- Consumers prefer the “no-compromise” option: better mileage without charging infrastructure worries.

In India, strong hybrids from Maruti Suzuki and Toyota are already outselling many pure EVs in the passenger car segment – a pattern the U.S. is now mirroring.

Global EV Growth Continues – But US Risks Falling Behind

Despite the American slump:

- Worldwide November Sales: Nearly 2 million EVs.

- 2025 YTD Global: 18.5 million units (+21%).

- China: Over 11.6 million YTD, dominating with affordable options.

- Europe: +36% growth in November, fueled by fresh incentives.

India, though starting from a smaller base, is projected to see EV sales triple in the coming years if policies remain supportive.

Key Lessons for India’s EV Journey

- Build affordable, practical models – not just premium ones.

- Expand charging infrastructure aggressively to reduce range anxiety.

- Consider hybrid pathways as a realistic bridge for mass adoption.

- Plan for a gradual subsidy phase-out to avoid a U.S.-style cliff.

As Indian companies like Tata, Mahindra, and Ola scale up, and global players eye the market, sustained policy clarity will be crucial.

Final Thoughts: Opportunity Amid Caution

The U.S. EV slowdown isn’t the end of electrification – it’s a reality check. For India and the global Indian community, it underscores that true mass adoption requires more than incentives: it demands vehicles that fit real-world needs and budgets.

English

English